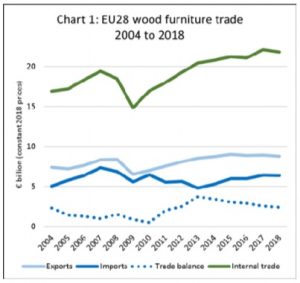

After a strong start to the year, the trade in wood furniture slowed sharply in the last quarter of 2018. EU imports of wood furniture from outside the region, which were up 6% in the first nine months of 2018, finished the year down around half a percentage point compared to 2017 at €6.36 billion. This is a reversal of the slow recovery in EU imports that began in 2013.

The decline in wood furniture imports closely mirrors changes in the wider European economy.

According to the EU Winter 2019 Economic Forecast published in February, economic activity in the EU cooled in the second half of 2018 as political tensions and uncertainty over fiscal policy and Brexit sapped business and consumer confidence and output in some Member States.

According to the EU Winter 2019 Economic Forecast published in February, economic activity in the EU cooled in the second half of 2018 as political tensions and uncertainty over fiscal policy and Brexit sapped business and consumer confidence and output in some Member States.

GDP growth in both the euro area and the EU slipped to 1.9% in 2018, down from 2.4% in 2017. Slowing economic growth fed through into a fall in the value of the euro and the British pound, both of which weakened against the U.S. dollar by around 8% during 2018.

These changing economic conditions are also indicated by a slowdown in internal EU wood furniture trade which, after hitting a peak of €22.1 billion in 2017, fell back nearly 7% in 2018 to €21.8 billion. The Brexit situation led to a slowing in UK imports both from within and outside the EU in the second half of 2018, while broader concerns about the EU economy contributed to a slowdown in trade elsewhere in the region.

The decline last year interrupts a long-term sharply rising trend in internal EU trade on-going since the financial crises in 2008-2009.

This long-term trend has been driven by increased market integration within the EU, the shift in manufacturing from higher cost countries in the western EU to lower cost eastern locations, particularly Poland, and the growing presence and influence of large-scale retailing chains operating at cross country level, most notably IKEA. More wood furniture imports into the EU from outside the region are also now being funneled via the Netherlands.

The drive towards greater integration of the EU furniture market and access to relatively lower cost manufacturing locations in the eastern EU partly explains the continuing dominance of EU-based manufacturers in the region.

EU-based manufacturers account for around 85% of all wood furniture sold in the region.

In recent years, European manufacturers have boosted productivity and competitiveness through investment in more advanced computer-controlled and automated manufacturing, cutting overheads and reducing the relative labour cost advantages of overseas producers.

There’s been a particularly large investment by Western European furniture manufacturers in Eastern European countries, notably since their accession into the EU from 2004, and this is now maturing. From being principally production satellites for large western European brands, Eastern European manufacturers are now developing their own identity and market momentum.

Furniture manufacturers in the EU area are also making a virtue of their shorter supply chains which not only reduce transport costs but also allow products to be delivered more rapidly.

External suppliers face other more direct challenges to expanding sales in the EU. Despite some recent consolidation, there is still a relatively high degree of fragmentation in the retailing sector in many European countries which complicates market access. Many overseas suppliers remain reliant on agents and lack direct access to information on fashions and other market trends. The progressive migration of European furniture sales online is also tending to favour local manufacturers better placed to meet the short lead times demanded by internet retailers and consumers.