Production and sales have been shrinking in Japan’s domestic wooden furniture manufacturing sector for more than a decade. Most of the decline is due to competition from imports and the inability of local manufacturers to upgrade their processing methods and raise productivity.

Wooden furniture imports continue to gain market share; it has been estimated that imports of bedroom, kitchen and dining-room furniture accounted for around 60% of the market in 2015. The growth in imports from China and Southeast Asian countries continues to hollow out domestic wooden furniture manufacturing.

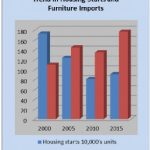

The figure shows trends in housing starts and imports of wooden office, kitchen and bedroom furniture. At first sight there appears to be a contradictory inverse relationship between trends in housing (falling) and imports (rising). Rather than a statistical anomaly, however, this reflects the rapid growth in the market share captured by imports.

The Japanese furniture market was worth around yen 900 billion in 2005, and imports of wooden office, kitchen and bedroom furniture accounted for about 16% of all domestic sales. By 2015, the size of the market had fallen to around yen 700 billion, and imports accounted for over 25% of the market.

Data from Japan’s Ministry of Internal Affairs and Communications show that purchases of wooden chests of drawers, a main item in the traditional “bridal furniture set”, have dropped dramatically over the past 15 years. On the other hand, household spending on dining-room furniture has been fairly stable—although relatively small compared with spending on bedroom items.

In the past, the bridal market was a main driver of growth in Japan’s furniture sector. It was usual for the bride’s family to buy a three-piece furniture set consisting of a wardrobe, a Japanese-style chest of drawers, and a dressing table.

Today, the traditional dressing-table has been replaced by western-style chests of drawers and, because many newly built houses and apartment have built-in closets, demand for free-standing wardrobes has faded. This, combined with the decline in the number of marriages, has upended the established demand patterns for wooden furniture in Japan.

- Housing starts and furniture imports, Japan, 2000 –2015

- Japan’s wooden kitchen furniture imports, 2015

Bedroom furniture

China’s exports of bedroom furniture to Japan accounted for 57% (by value) of all wooden bedroom furniture imports in 2015. The second-ranked supplier last year was Viet Nam, with 28% of all imports, and other Southeast Asian countries made up around 8%. The combined market share of these three suppliers in 2015 was over 90%, the balance coming mainly from Europe and North America.

Kitchen furniture

Fitted kitchens are now a standard feature of newly constructed houses and apartments, and the replacement kitchen market is growing strongly as owners of existing homes embrace renovation to avoid the cost of demolition and rebuilding (once a feature of the Japanese housing sector).

In the early days of kitchen modernization, European and North American makers of kitchen units and cabinets found a ready market in Japan. It took suppliers in Asia only a short time to grasp the opportunity, however, and they began growing their market share.

Manufacturers of kitchen furniture in Viet Nam have secured a significant part of the market (41% in 2015), as have shippers in Indonesia, Malaysia and Thailand. Demand for European kitchen furniture tends to focus on German and Italian lines in the up-market housing sector.

Hollowing out the furniture manufacturing base Japan’s domestic furniture manufacturing sector has declined as Japanese companies—even small and medium-sized companies—have shifted production outside Japan to countries where production costs are lower, populations are growing and there is good infrastructure and communications. In Japan’s wooden furniture market, relocated Japanese companies are responsible for much of the export trade from China and Southeast Asia to Japan.

China was once the preferred destination for relocating Japanese companies—it is close to Japan and has good shipping connections. Moreover, wages and energy costs have been much lower than in Japan, and domestic demand has grown rapidly. This has now changed, however: rising wages, labour disputes, and the reemergence of bitter historical issues are causing many Japanese companies to look elsewhere for their investments.

Viet Nam has attracted Japanese companies, and the trade relationship between the two countries is very close. Viet Nam’s overall exports to Japan are now almost 10% of all its exports, ranking second after North America. The main products exported to Japan are garments, seafood, wood products and electronics. In 2015, around 1000 Japanese companies had production capacity in Viet Nam.

Expansion of single person homes creates opportunities

Trends in Japan’s housing sector are central to the future of the furniture manufacturing sector (whether domestic or off-shore). Japan’s population is aging and shrinking due to a low birth rate. The population peaked in 2005; the number of households is increasing for now but is projected to decline after 2019. The number of people aged over 65 years is expected to level off in 2025 and decline from 2040.

Superimposed on these trends is the expectation that the population of greater Tokyo, which is rising, will begin to fall in about ten years, when the number of households will also begin to fall.

The other major force to influence furniture demand is the current upward trend in one-person households, driven by changes in culture and lifestyles, which should peak in 2030. Young professionals are shying away from early marriage in order to focus on their careers. Since 1973 there has been a 33% decline in the number of people getting married; moreover, the divorce rate is rising fast.

As the numbers of divorcees and never-married adults increase, single-person households are the fastest-growing household group and will eventually become the largest such group in Japan. Singles need less space and can therefore save on rent and house-building costs. When space is limited, furniture needs to be both pleasing and practical. Storage cabinets are popular among singles in small homes, and many guides to living in small spaces—with a focus on storage techniques—are available.

Demolish and rebuild or renovate

Typically in Japan, detached wood-frame homes around 30 years old are considered worthless by lenders and by those looking to buy. This rapid depreciation is more a reflection of tradition than the soundness of residences, however—homeowners in Japan were raised to believe that wood-frame homes do not last and must be demolished and replaced.

Understanding the extravagant waste of resources such a tradition has created, the Japanese government has introduced measures to encourage lenders to place a value on renovated homes and apartments and extend the depreciation of homes to around 50 years. The house and apartment renovation market is booming as small, medium-sized and even major developers are realizing its potential.

Room for innovation and creativity

There is potential for segments of the Japanese furniture market to grow, especially for competitively priced items designed for singles in small spaces, such as drawers, cabinets, fold-away dining tables and dining chairs. Manufacturers offering a range of styles—from traditional Japanese to Scandinavian—will find an ideal market base if the focus is on the tasteful use of colour and simple designs at reasonable prices.

Japanese consumers have always been rather predictable and generally looked on low-priced goods with disdain, preferring to shop in recognized national-brand stores and outlets and prepared to pay for quality.

Now, however, they have started behaving like their overseas counterparts, who for years have enjoyed discount stores (including, in recent years, online stores) finding low priced, serviceable items that will last until individual tastes or fashion dictate replacement.

This fundamental shift in the attitudes and behaviour of Japanese consumers has been reinforced by the current state of the national economy and the impact this is having on incomes and job security. It is likely to continue, even when the country’s economic prospects eventually improve.

[gravityform id="1" title="true" description="true"]

[gravityform id="2" title="true" description="true"]

Source:ITTO